Headquartered in Amsterdam and San Francisco, Adyen is a leading payments technology company that provides businesses with a single global platform to accept payments around the world. Driven by a vision to improve customer experience, streamline processes and ultimately increase revenues for companies, Adyen enables them to process payments across online, mobile and point-of-sale with over 250 payment methods and 150+ transaction currencies. We speak to Michel van Aalten, Senior Vice President of Business Development, at Adyen’s Sydney base within our Reservoir by The Office Space location. Discover how the company combines all the pieces of the payments puzzle into one platform that allows companies to accept any number of payment methods worldwide. With offices across North America, South America, Europe and Asia, Adyen services more than 3,500 businesses and four of the five largest U.S internet companies, including well-known brands such as Netflix, Spotify, Dropbox, and Vodafone. So what is your role at the Sydney HQ? With a growing team working out of our Sydney office, we work with merchants in Australia and New Zealand to build payment solutions that reflect the changing demographics and uniqueness of the Asia Pacific markets. Our work also helps merchants shape better customer relations. However, the global nature of e-commerce means our customers don’t just operate in one country. More often than not, we work with Australian merchants looking to access global markets, or with global merchants trying to reach Australian consumers. With that in mind, we make it a priority to develop an in-depth understanding of global payment preferences. Essentially, Adyen provides businesses with a single solution to accepting payments anywhere in the world, replacing multiple suppliers for the gateway (with associated risks) enabling companies to streamline their operations and reduce costs. Can you explain how Adyen’s offering differs to other major global online payment systems such as PayPal? At Adyen, we believe in connecting directly to payment methods. We have built an entirely new route to payments processing without any legacy systems on the back end – delivering much higher quality and efficiencies for our customers. Adyen is the only company offering a single platform for e-commerce and in-store. In addition to delivering higher customer satisfaction, it reduces the risk of failed transactions. We share with our merchants the market knowledge and customer payment preferences globally. With e-commerce becoming more global in nature, we work with our merchants to successfully reach customers in various markets by connecting them to their preferred payment method. Founded in Amsterdam only ten years ago, can you tell us about the core principles of Adyen’s global growth strategy over its start-up years? At Adyen, we aim for organic growth and do not depend on third-party technical infrastructure. This removes the complexities from the payment process and allows us to scale our solution easily. Instead of relying on multiple partners to cover all geographies and sales channels, it’s possible to work with just one – Adyen. With that principle in mind, we’ve built our payments platform to enable global e-commerce. The Adyen platform supports a variety of payment methods and several currencies, from Alipay and WeChat Pay in China, to debit cards in Europe, cash-based payment methods in Southeast Asia, and Boleto Bancário in Brazil. This means e-commerce businesses can go global and support the payment methods local shoppers expect and trust. This is an extremely powerful proposition for our customers, and it is reflected in our growth. In 2015, Adyen processed over US$50 billion in transaction volumes, up from US$25 billion in 2014. We achieved revenue of US$350 million, a growth of more than 100 percent over 2014. The results underscore how Adyen is building its position as the global partner of choice for international e-commerce. In 2015, Adyen achieved a valuation of $2.3 billion, making it the 6th largest European unicorn (a start-up company valued at over $1 billion). With such incredible success, where do you envisage your growth areas will be over the next ten years? The Asia Pacific region remains an important area of growth. We have three offices in Sydney, Singapore and Shanghai. We support a range of local payments, helping our customers like Cathay Pacific and Foodora offer their customers the payment methods that they trust and feel comfortable with. In terms of growth areas, our focus remains on the on-demand or subscription economy, led by businesses such as Netflix, Spotify or Uber. The payments step is absolutely crucial for these businesses, as a failed payment means the end of the subscription and quite possibly a lost customer. We’ve also heard that that Adyen is adding in-store payments to its repertoire. Is it simply a case of amalgamating multiple systems for stores and offices for one company with outposts across a city, country or even the globe upon one information storage and processing platform? Adyen’s approach is to work with merchants to offer their customers the payment methods that they trust and feel comfortable with. This differs from country to country. For example, Apple Pay and Samsung Pay may be more well-known globally, but it is hard to dispel the power of in-store payments for emerging economies. In Indonesia and Thailand, internet penetration still has plenty of room to increase. However, trust issues around the security of online and mobile payments persist, and partly due to this, methods such as cash on delivery still account for the bulk of online purchases. We support a range of online banking and convenience store/ATM payment methods, including Mandiri Clickpay, Gcash and Maybank2u in these Southeast Asian markets. What are the advantages of this compared to current in-store payment practices? For the shoppers, our unique omnichannel payments technology allows them to move seamlessly from in-store to the mobile app and the online store at their own convenience. Secondly, an in-store payment system enabled by omnichannel technology would allow merchants to recognise their customers across sales channels. Because all transaction history is collected in one system, it gives businesses the chance to trigger targeted offers or offer a rewards program. On top of that, Adyen’s tokenisation function stores customer card details in-store and online so returning shoppers needn’t enter their card details a second time. This personalised and targeted payments solution is a good update from current in-store payment practices and ensures customers enjoy a seamless payment experience. What other unique payment solutions does Adyen offer? We offer RevenueAccelerate and RevenueProtect as part of our unified payment solution. RevenueProtect is an integrated risk management system that is built directly into the Adyen payments platform and designed to maintain the right balance between fraud defense and optimised conversions. Spotify, for example, was able to decrease chargebacks by 70% with RevenueProtect. RevenueAccelerate compliments RevenueProtect by turning wrongly refused card transactions into approvals. This ensures transactions are not declined because of glitches in the system and helps merchants generate more revenue by driving authorization rates and increasing customer revenues. Lastly, what do you envisage to be the most broadly used e-currency over the next 5-10 years, and what dramatic changes do you see us undergoing in our day to day operations regarding both ‘real’ and electronic shopping experiences to make them more efficient? While e-currency is an on-going trend, some of the most innovative payment technologies revolve around customer convenience. For example, the zero-click transaction – which takes place in the background, without any action required by the customer. This kind of frictionless connectivity brings businesses closer to their customers and will spread rapidly. The blurring of lines between online and in-store payments is another promising segment. Now, shoppers can make a purchase in store without having to provide their full data, based on information stored from a previous transaction online or via their mobile. This ensures a smooth recurring payment experience for repeat customers. These trends change the way merchants think about payments and offer new experiences for shoppers. They will have an invaluable impact on driving sales and streamlining processes and costs.

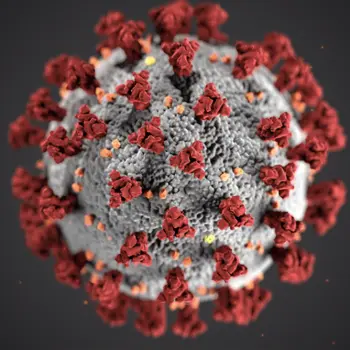

December 2019 Covid Update

Updated 7/12/20 The Office Space’s COVID-19 Safety Plan outlines our commitment to providing a carefully managed workspace that upholds the guidelines and the best practice advice of NSW Health, the Federal Government…

Read More